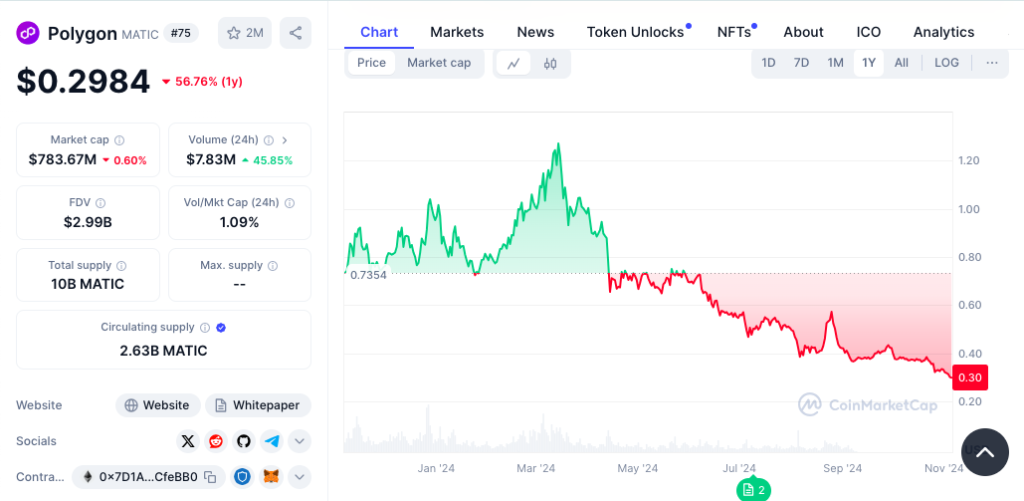

Polygon (MATIC), a major Layer 2 scaling solution for Ethereum, faced a significant price decline this year, dropping nearly 25% after hitting a recent high. Have you wondered why this token struggle?

Here are the main reasons behind this drop:

Technical Market Pressures

MATIC’s price saw a surge earlier in the year, peaking around $0.58 as demand for Layer 2 solutions grew due to Ethereum’s high fees and congestion.

However, the momentum was short-lived. Technical indicators showed bearish signals: the Relative Strength Index (RSI) suggested that MATIC was moving out of an overbought range, and a bearish crossover in the Moving Average Convergence Divergence (MACD) implied more potential declines.

Additionally, MATIC failed to maintain support above critical Fibonacci levels, a common benchmark for traders, leading to further sell-offs.

Binance’s Token Migration

Another key factor influencing MATIC’s decline is Binance’s recent announcement of its migration from using MATIC to a new token, POL.

This change aims to enhance Binance’s blockchain infrastructure but has raised concerns about liquidity and market demand for MATIC. Some investors are cautious, waiting to see how this transition affects MATIC’s position in the market.

Broader Market and Economic Conditions

The larger cryptocurrency market has been highly volatile, with significant declines in Bitcoin and Ethereum also affecting altcoins like MATIC. Inflation concerns, rising interest rates, and global economic instability have increased uncertainty among investors, who are moving towards safer assets, thereby pressuring MATIC’s price further.

Polygon (MATIC) Price Prediction

Despite the dropping price this year, Coincodex.com is still optimistic, MATIC is expected to be priced between $1.79 and $4.24 by 2030. Conversely, experts from Changelly predict a wider range, estimating minimum and maximum prices of $10.28 and $12.56 by the end of that year.

Different analysts have diverse views on the future value of Polygon (MATIC). For example, DigitalCoinPrice forecasts that MATIC could reach $2.43 in 2023 and $3.91 by 2025.

Their long-term projection for 2030 is $11.45. This optimistic outlook is based on the belief that Polygon’s growing adoption and scalability solutions will significantly boost its value.

Moreover, Polygon’s fast transaction processing and lower fees compared to Ethereum have kept it attractive for decentralized applications (dApps). This increased adoption may signal long-term potential, even as MATIC faces near-term challenges.

.gif?updatedAt=1768976623251)

Leave a Reply